Cash flow is the lifeblood that drives growth, innovation, and sustainability in the modern business landscape. The significance of effectively managing cash flow cannot be emphasized as supply chains become more complicated and global. Enter digitalization, a revolutionary strategy that uses technology to improve every aspect of the supply chain. The question arises, why should it be digital? In this article, we'll explore how supply chain digitization matters and may greatly enhance cash flow and promote overall business performance.

Streamlined Procurement and Inventory Management

Digitizing the supply chain starts with transforming procurement and inventory processes. The transformation issue leads to reduced costs, enhanced efficiency, improved cash flow, streamlined approvals, and enhanced data visibility of business. This main phase of digitizing transformation processes is to reduce manual errors caused by humans. Generally, digital platforms will be used as tools of transformation. Utilizing digital processes of the supply chain through platforms and Internet-of-Things (IoT) sensors enables real-time monitoring of movement, quantity, and status of inventory items in various stages. Businesses may proactively manage stock levels, optimizing working capital allocation, and preventing stock-outs that disrupt operations and excess inventory that uses up cash, with the help of immediate insights into inventory levels. In some cases, the bottleneck could be supported and solved immediately to improve business performance.

The support for IoT in the digitalization process also impacts automated reordering on business. Advanced algorithms can forecast demand, lead times, and other relevant factors based on historical basis data and current market trends. Moreover, automated reorder triggers ensure that inventory is replenished at optimal levels, preventing excess tied-up capital of the business.

Efficient Order Fulfillment and Delivery

Digitization enhances order processing, shipment tracking, and delivery efficiency, directly impacting cash flow. The order processing is more efficient regarding faster orders and reduces the error process. Digital systems allow for automated order entry, reducing the time and effort needed to process orders manually, which expedites the order-to-cash cycle of business. In fact, digital order processing can streamline digital orders potentially reducing administrative costs, and accelerating order fulfillment, leading to quicker revenue realization.

Moreover, the digitalization of the supply chain really impacts real-time shipment tracking. Digital platforms and IoT technology provide real-time visibility into shipment locations and delivery times. This visibility reduces delays for business and prevents payment delays from customers. Both the customer and supplier can track eventually the whole shipment process. It means, the process increases operational effectiveness through digitizing the order processing, shipping tracking, and delivery processes, and it has a direct and advantageous effect on cash flow.

Predictive Demand Forecasting

Predictive demand forecasting is the forecast strategy of future consumer demand for goods or services. Predictive forecasting utilizes historical data, statistical analysis, and advanced modeling techniques. The statistical technique is more useful in this process since it can find trends, correlations, and patterns in the data that have been gathered. The results of forecasted future demand determine strategic management policies or decisions. This data-driven prediction will anticipate market demand accurately to optimize inventory management, production planning or production schedules, procurement, and logistics. Data analytics and AI would analyze historical sales data, market trends, and external factors with AI-driven algorithms that help predict demand more accurately.

Digital Payments and Invoicing

This method, digitizing payment and invoicing, facilitates financial transactions and invoice processing between businesses, suppliers, and customers to improve efficiency, reduce cost, and enhance transparency. Afterward, the digital transformation extends to payment processes, expediting cash inflows and outflows. These technologies streamline financial processes and can significantly influence the timing and efficiency of cash transactions. It would really depend on how fast the invoice is published to impact the cash flow cycles. By electronic invoicing (e-invoicing), digital invoices are sent and received instantly, reducing processing time and accelerating payment cycles. This leads to quicker payment receipt and improved cash flow. On the other hand, digital payment options would help customers accelerate the collection of funds, reducing days sales outstanding (DSO) and improving liquidity.

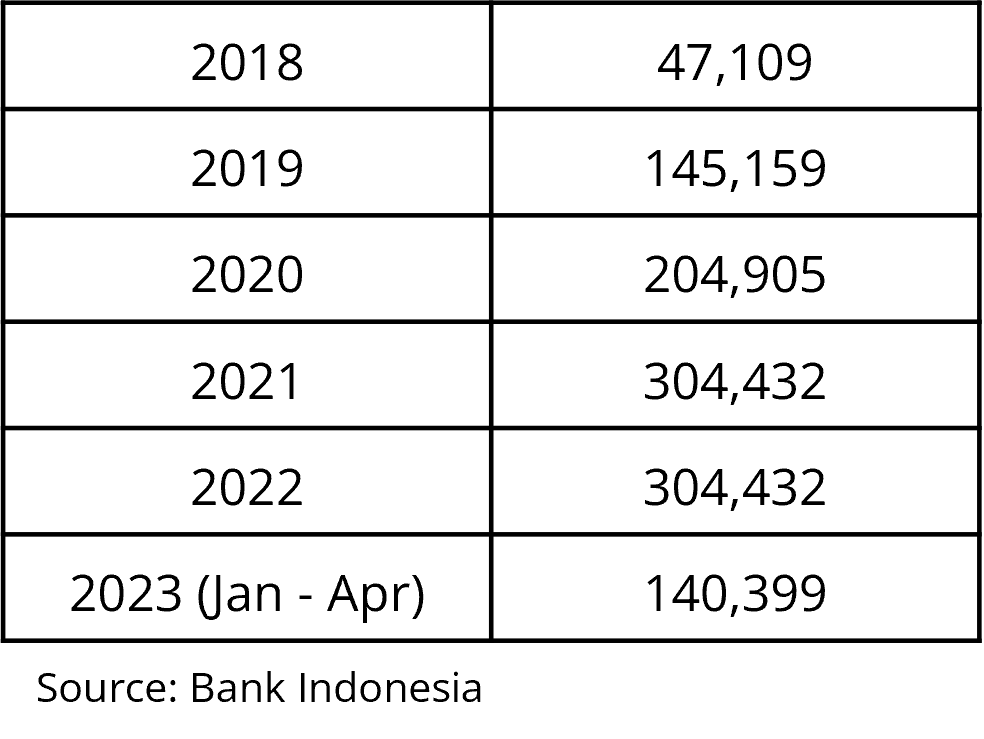

In Indonesia, an interesting phenomenon to explain the behavioral change of Indonesian people using digital payment is during the pandemic. The use of digital payments is rapidly increasing yearly (YoY) in 2018-2022, even when the pandemic has passed this behavior is still happening. On the other side, rising purchasing power and growing Internet and smartphone penetration, are also the impact of the behavior change and rapidly developing digital infrastructure that facilitates this trend. Bank Indonesia data, shows the transaction value of purchases using electronic money in Indonesia (IDR billion):

Enhanced Supplier Collaboration

Digitization encourages greater supplier engagement, resulting in improved terms and circumstances that have a favorable effect on cash flow. Both sides benefit from efficient business processes, which also help businesses succeed (making money). In several cases, digitizing the supply chain leads to a specific platform that facilitates collaboration, communication, transactions, etc. The platform enables effective collaboration between buyers and sellers on procurement processes. Long-term partnerships are strengthened and innovation is facilitated via these platforms. Digital communication tools, such as email, messaging apps, and collaborative platforms, facilitate seamless and rapid communication between supply chain partners. This facilitates rapid issue resolution, improved collaboration, and more rapid decision-making, improving cash flow and ultimately enhancing the performance of the supply chain as a whole.

Conclusion

Looking to maximize cash flow, reduce expenses, and maintain competitiveness, digitizing the supply chain is not just a choice; it is a strategic need of business. Digitization improves operational efficiency, reduces the need for working capital, and speeds up revenue realization by improving procurement, inventory management, order fulfillment, and payment processes. This all-encompassing strategy fosters partnerships with suppliers and consumers, while enhancing cash flow, fostering long-term success in the competitive market. Take advantage of digitization to make your supply chain more streamlined and cash-efficient.

Digitizing your supply chain process and creating real-time supply chain visibility can be a starting point for your business. Get in touch with ASYX today and let our experts help you take the first step towards greater operational efficiency and a healthier supply chain. Learn more about our Supply Chain Collaboration and Business Insights platform here.